INSIGHTS

2024 E-INVOICING

National E-Invoicing Initiative

To support the growth of the digital economy, the Government intends to implement e-Invoice in stages in an effort to enhance the efficiency of Malaysia’s tax administration management. This is in line with the Twelfth Malaysia Plan, where one of the key focus is on strengthening the digital services infrastructure and digitalising the tax administration.

The e-Invoice will enable near real-time validation and storage of transactions, catering to Business-to-Business (B2B), Business-to-Consumer (B2C) and Business-to-Government (B2G) transactions.

WHY DO WE NEED E-INVOICING ?

OBJECTIVE

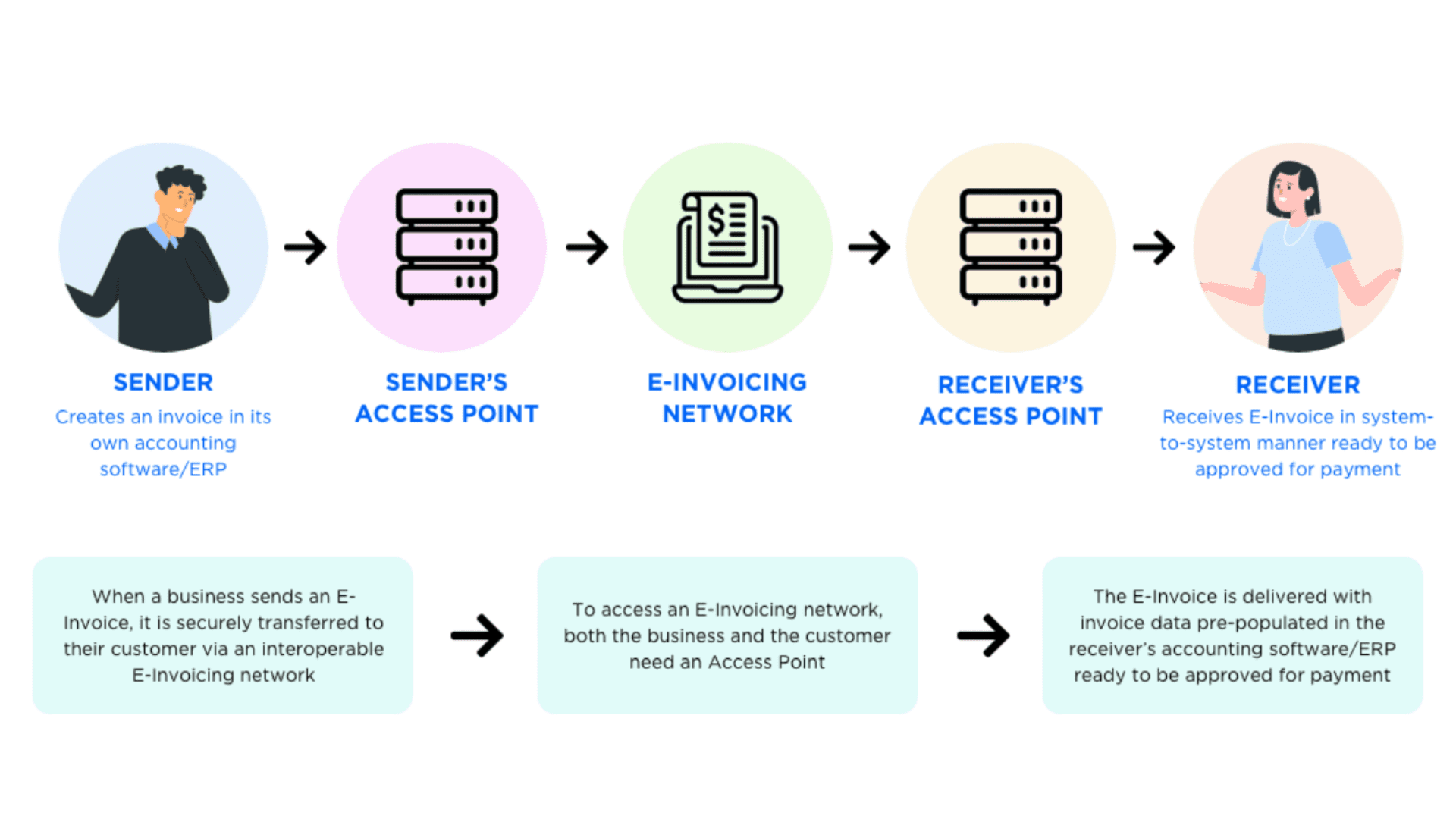

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) system to send and receive e-invoices in a system-to-system manner.

WHAT IS GOOD FOR US ?

BENEFITS

HOW E-INVOICING WORKS ?

PROCESS

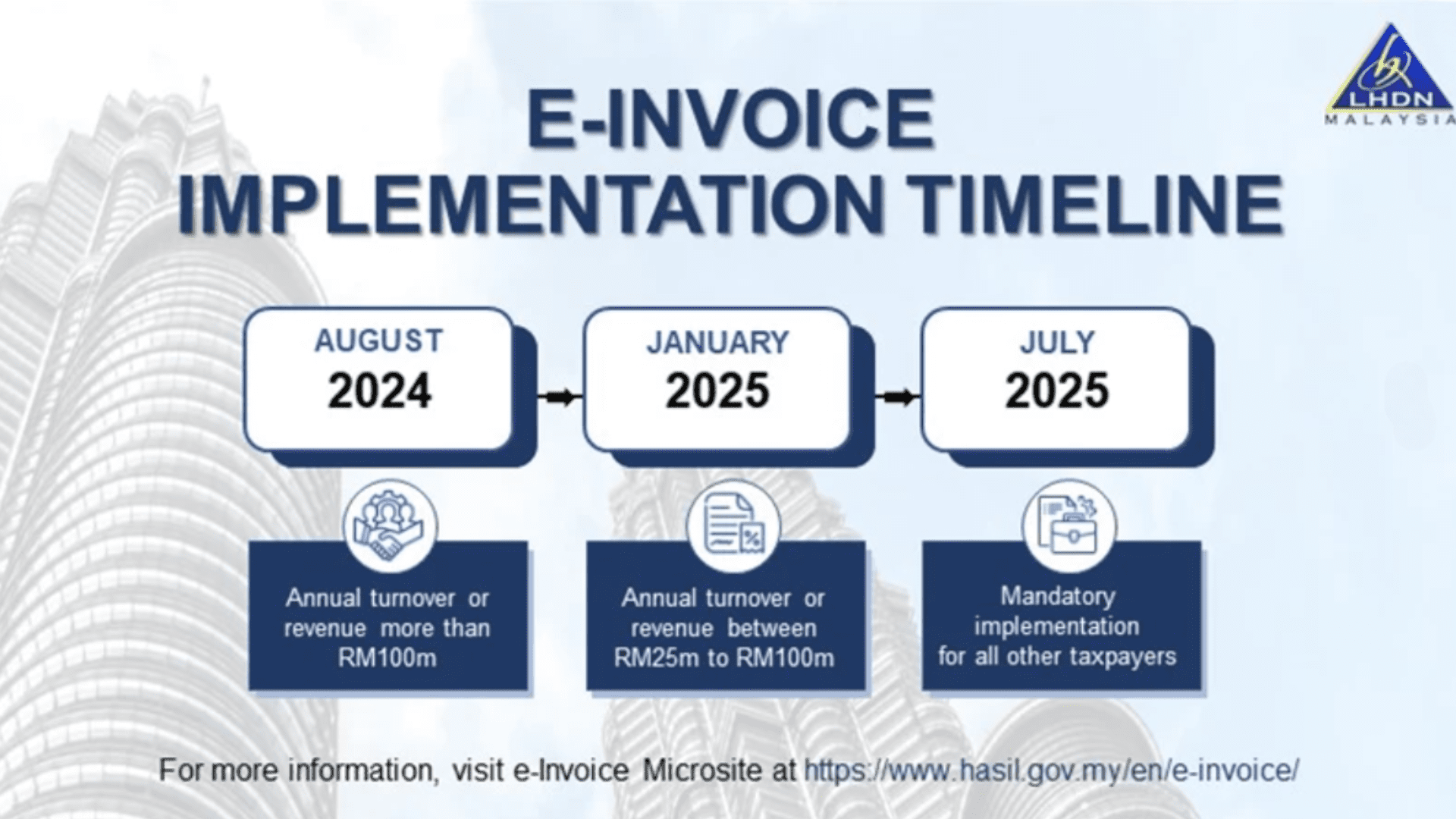

WHEN WILL IT BE IMPLEMENTED ?

E-INVOICE IMPLEMENTATION TIMELINE

FAQ

Questions Regarding E-Invoicing

Which E-Invoicing frameword will be used in Malaysia?

The Peppol E-Invoicing framework is considered to be the most suitable for implementation in Malaysia due to its maturity, interoperability, and well-governed standards. It is also the most widely used E-Invoicing framework globally, adopted by more than 20 countries. (refer to country list HERE)

What is a Peppol Authority?

The function of a Peppol Authority is to manage the implementation of the Peppol framework in a particular country. This includes localising the Peppol standards to suit local requirements and to accrediting service providers that adhere to the Peppol standards. MDEC functions as the Peppol Authority for Malaysia.

Is it compulsory for every business to implement E-Invoicing for tax reporting?

According to LHDNM’s website, businesses with an annual turnover of RM100 million and above will be mandated to implement e-Invoice for tax compliance on 1st August 2024. The implementation of e-Invoice will be mandatory for all businesses on 1st July 2025. For the latest information on e-Invoicing for tax reporting and compliance, please click here.

We are a large company/business owner. Should I replace my current accounting software/ERP System to adopt this initiative?

You should not be required to replace your current systems. This initiative aims to standardise the specification and message format used for the transmission/exchange of e-invoices between different accounting software/ERP systems. The standardisation of the e-Invoice format is technically configured in your accounting software by your service provider. Consult your accounting service provider to determine whether they can/will support the Peppol framework. If you would like to know more details, you may reach out to us at clic@mdec.com.my

Is e-Invoice applicable to transactions in Malaysia only?

No, e-Invoice is applicable to both domestic and cross-border transactions. The cross-border transactions include import and export activities.

For clarity, the compliance obligation is from the issuance of e-Invoice perspective. In other words, taxpayers who are within the annual turnover or revenue threshold as specified in Section 1.5 of the e-Invoice Guideline are required to issue and submit e-Invoice for IRBM’s validation according to the implementation timeline.

What are the thresholds for e-Invoice implementation to be applicable to taxpayers?

All taxpayers are required to implement e-Invoice according to the annual turnover or revenue thresholds.

In relation to a company, the annual turnover or revenue threshold refers to the annual turnover or revenue value as stated in the statement of comprehensive income in the FY22 Audited Financial Statements.

Are all industries included in the e-Invoice implementation? Are there any industries exempted?

Currently, there are no industries that are exempted from the e-Invoice implementation.

Note that certain persons and types of income and expense are exempted from e-Invoice implementation. Refer to Section 1.6 of the e-Invoice Guideline for further details.

Will all businesses be required to issue e-Invoice?

Yes, all businesses will be required to issue e-Invoice in accordance to the phased mandatory implementation timeline, which is based on the business’ annual turnover or revenue threshold.

Is there any adjustment window allowed to the supplier to cancel an invoice submitted to IRBM?

Yes, there is a 72-hour timeframe for the e-Invoice to be cancelled by the supplier. Refer to section 2.4.6 of the e-Invoice Guideline for further details.

More questions? Click Here.